Journal CSS

The Journal of The Institute of Circuit Technology Vol 13 No 3 December 2020 |

|

| Links to Contents |

Section |

| 1 | |

| 2 | |

|

Market Update: Raw Materials & Logistics Drive Price Increases for Copper Clad Laminate & Prepreg |

|

|

Institute of Circuit Technology Webinar Review 19th Nov 2020 |

|

|

A Market Research Project in Industrial Applications for a University Developed Technology - SMMF |

|

|

Research Papers |

|

|

|

|

| 10 | |

|

Industry News: Adeon, Exception PCB, Eurotech, ParaChem, Merlin, Ventec |

|

|

Members News, Chris Wall - Electra, Phil Danter - Exception PCB, |

|

|

Section 1 |

Editors Introduction New Year, New Challenges. |

|

Lynn Houghton Journal Editor |

Well, we made it to the end of this tumultuous year. Unfortunately we have lost good people with long service to redundancy. We wish them well and hope that new positions will come in the New Year. Remember, we are still here to support you. Now the challenges of recovery come, starting in January with the twin pressures of ”lockdown rebound in demand” and “BREXIT, Congestion at UK ports", Mark Goodwin (Section 4 paper 1).So far, this has been a K-shaped recovery with winners and losers. Now that we have the vaccine and our greater understanding of the virus we should see more businesses coming back from the brink. In this journal we have featured views of the future with Francesca’s Outlook going forward to 2022 and Mark’s comprehensive report on supply chain, pressures, price and availability. I recommend them both to you. We have a report on our first webinar, our webinar seminar, not quite the *Majestic” event that we are used to! The industry news and members news sections have topical items of interest. In the next journal, we will feature 5G technology. Papers, reports on this and other areas of interest including news and comments are eagerly anticipated. Submission date is 19th February 2021. May I and your friends in the ICT wish you all a well-deserved break that leaves you refreshed and ready for a busy year. Lynn Houghton |

|

Section 2 |

Editorial Covid-19 The Way Ahead |

|

Richard Wood-Roe ICT Council |

While writing this editorial the United Kingdom and most of Europe are in some form of lockdown. Deaths are astonishingly high. Once upon a time you could have some confidence that if you were seriously ill you would go to hospital and be fixed up. Not so with the covid-19 virus which has ripped the heart out of so many families. It is extraordinary the amount of conspiracy theories that are rife. One would have thought that with so much internet communication the truth would prevail. Instead we are inundated with crackpot theories that range from "It is all government driven to eliminate cash from circulation" to a “New world order which is being directed by Apple, Amazon, Twitter and 5G manufacturers”. Or that “The collective human mind is manipulated from the Moon, which is controlled by the reptilians, who broadcast a virtual reality to our brains”. Honestly whatever next! The talk is all about vaccines now and the protection they give that will allow our lives to return to some form of normality. The world stock markets certainly think so. In November the Dow Jones Index broke the 30,000 barrier for the first time and the FTSE100 has had the best month in 30 years. Regulatory approval has just been announced for the Pfizer vaccine. The UK has secured a world first in granting this approval. Despite the conspiracy examples of naivety and ignorance, the phenomenal height of what science, academia and industry can achieve in such a short time is a lighthouse in these dark days. Manufacturing, retail, sport and hospitality so need some good news. However, once again we are deluged with negative anti-vac conspirators who will potentially damage the take up of vaccinations and delay their effect. I was amazed to read today that 59% of the population in France do not want to be vaccinated. I do hope that for the sake of our manufacturers, suppliers, customers and employees we can put 2020 behind us and get back to concentrating on innovation, productivity, quality and service. This will be key for the success of our printed circuit industry. Richard Wood-Roe |

|

Section 3 |

Calendar of Events |

|

Date |

2020 Events |

|

25th February |

AGM and Evening Symposium |

|

6th - 9th April |

Annual Foundation Course - Chester - POSTPONED |

|

2nd June |

Annual Symposium at the British Motorcycle Museum - POSTPONED |

|

8th September |

Autumn Seminar -Tewkesbury POSTPONED |

|

19th November |

ICT Webinar |

|

TBA November |

Winter Seminar - Hartlepool POSTPONED |

|

|

2021 Events |

|

25th February |

AGM Webinar / Zoom Meeting |

|

|

|

Section 4 Paper 1 |

Market Update: Raw Materials & Logistics Drive Price Increases for Copper Clad Laminate & Prepreg Mark Goodwin |

||||||||||||||||||||||||||||||||||||

|

Mark Goodwin COO EMEA & Americas, Ventec International Group |

Is This The Perfect Storm?

As we reach the end of a difficult year managing the many challenges caused by the COVID-19 pandemic, another series of challenges is rapidly coming into focus for EMEA and North American PCB manufacturers and their supply base. Increased demand, static capacity, and industrial accidents have all come together to cause longer lead-times, reduced availability, and upward price pressure for key raw materials. These factors are likely to have a mix of long, medium and short-term effects on the outlook for CCL & PP prices, but the pressure is building for significant and, in the case of copper foil, sustained price rises that would start coming into effect in early 2021. Demand for copper foil is increasing from both PCB and battery production for e-mobility leading to an upward price pressure for copper foils as post lockdown pent-up demand starts to exceed capacity. Lead-times are stretching and prices increasing particularly for heavy copper foils (2oz / 70 micron and above) as capacity is repurposed to maximize SQM output for light weight foils to increase capacity for lithium battery production.

Source: Ventec International Group With the forecast growth for battery demand, long lead-times, and high investments costs to increase copper foil manufacturing capacity, this situation is unlikely to ease given the policy statements and green agendas of most governments for the coming 5-10 years. The lithium battery forecasts for China alone, for example, give a strong indication of the impact on supply & demand, and price pressure for copper foils in the coming 10 years

Remark: Every Gwh will consume 900Tons of copper foil Source: Ventec International Group (data sources incl. Co-tech Development Corp. & Taiwan Copper Foil Manufacturing Association)

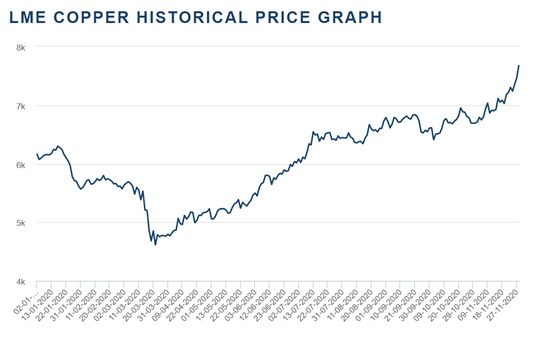

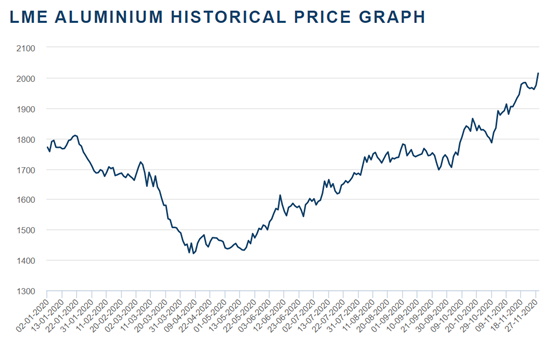

Similar conclusions were made in a recent report from Goldman Sachs who predict a sustained bull market for copper: “a bull market for copper is now fully underway with prices up 50% from the 2020 lows, reaching their highest level since 2017. This current price strength is not an irrational aberration, rather we view it as the first leg of a structural bull market in copper.” Goldman Sachs analysts raised their 12-month forecast for copper to US$9,500 per metric ton, up from a previous estimate of US$7,500. The Wall Street bank said it now expects a sustained, higher average price for 2021 and 2022. It has estimated copper prices will average around US$8,625 next year, before climbing to an average of US$9,175 in 2022. By the first half of 2022, Goldman Sachs analysts said, it is “highly probable” copper would test the existing record highs of US$10,170 set in 2011. Demand for aluminum in insulated metal substrates (IMS) and metal backed printed circuit boards (MPCB) continues be driven by the demand for thermal management solutions for high powered LED general & automotive lighting applications, as well as power conversion applications associated with e-mobility charging infrastructure and green energy generation, and all the competing industrial and consumer applications. As demand from these sectors starts to pick-up pace, post pandemic lockdown prices are starting to rise above their pre pandemic levels, introducing price pressures to the supply chain.

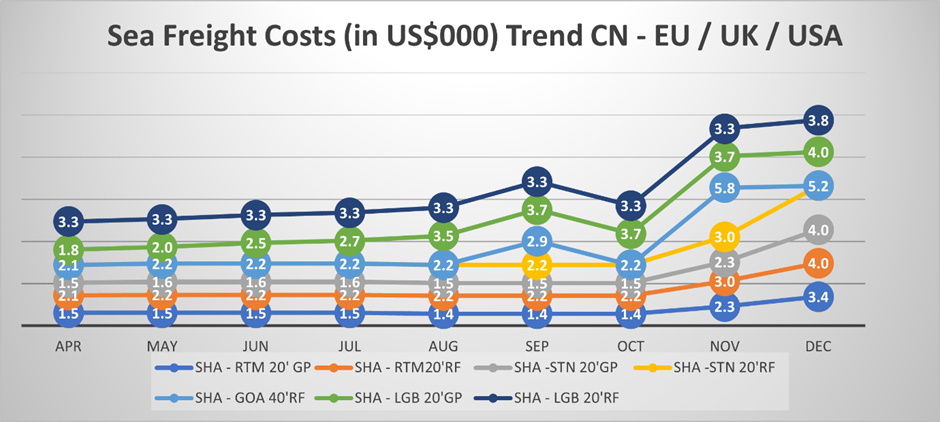

Source: London Metal Exchange (www.lme.com) High demand for epoxy resins for green energy applications (wind turbine blades) in China, coupled with recent industrial accidents at volume resin manufacturing facilities in China & Korea has led to shortages and significant (60%) price hikes for CCL manufacturers in the last two months. The impact is mostly felt in standard (130-135oC) Tg FR4 laminates & PP production costs and has already fed through to December 2020 price increases of 15-20% at the factory gate. These increases will be felt in Europe and the USA from early Q1 2021 as inventories in these markets are replenished with higher cost stock. Upward price pressure has also been building for Mid and High Tg phenolic cured FR4’s since the end of August 2020. The cumulative effect to date is around 15-20%, which will equate to 5-10% increases for CCL & PP in early Q1 2021. High growth in consumer and green energy applications is also pushing up glass yarn and glass fabric prices and limiting availability, particularly for heavy weight fabrics such as 7628 and 2116. Glass fabric manufacturers tend to follow the demand for those materials which have lower quality demands and command higher market prices, than those demanded by the PCB industry. The CCL manufacturers expect that this trend will cause laminate shortages, particularly for rigid materials. High year-end enquiries and order levels in Asia are always a solid precursor of both availability limitations, and significant price increases in early 2021. This has already been confirmed by market price increase warnings issued by the global market leaders in rigid CCL production. Supply chain logistics are another cause of concern as demand picks up post pandemic lockdown. There are significant capacity constraints affecting the availability of both sea & air freight. Market data shows that air freight demand is close to returning to 2019 levels, but the available capacity is down by 24% due to the lack of passenger flights. Price levels are down from the early pandemic highs of 4-5X pre pandemic rates. However, the price trend is upwards from summer 2020 levels of 1.5X pre pandemic rates and currently sitting at 2-2.5X pre pandemic rates due to very high seasonal demand. They are expected to remain high in 2021 and until a significant increase in passenger air traffic increases available cargo capacity. For sea freight demand is high due to a post pandemic lockdown rebound in demand, leading to two major issues: a shortage of both dry and refrigerated containers, and a high differential in pricing on Asia to Europe / UK and Asia to USA shipping routes. This differential towards more profitable USA routes is driving up prices for container traffic between Asia and Europe/UK, and freight rates to the USA are already very high.

Today more than ever, suppliers that own and control the complete supply chain of PCB materials including laminates, and prepregs from end to end, have a clear advantage. Maintaining carefully managed inventory in various locations worldwide gives the flexibility to adapt to these unforeseen events outside normal control, such as pandemics or industrial accidents! Building a supply chain capable of handling the challenges we all encounter - those we can control and those we cannot - is ultimately dependent on the quality of dialog between supplier and customer. The more we can work together, and establish those close, strong, and enduring relationships to the benefit of all parties involved, the easier it will be to navigate these challenging times. |

||||||||||||||||||||||||||||||||||||

| Go back to Contents | |||||||||||||||||||||||||||||||||||||

|

Section 5 Paper 2 |

Outlook for the UK Electronics and PCB IndustryFrancesca Stern |

|

Francesca Stern Francesca Stern Consulting |

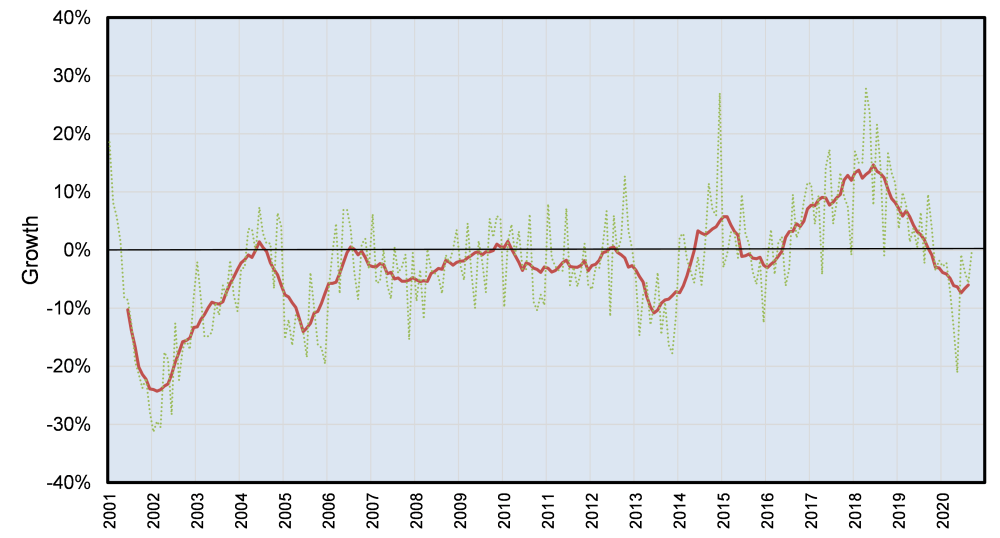

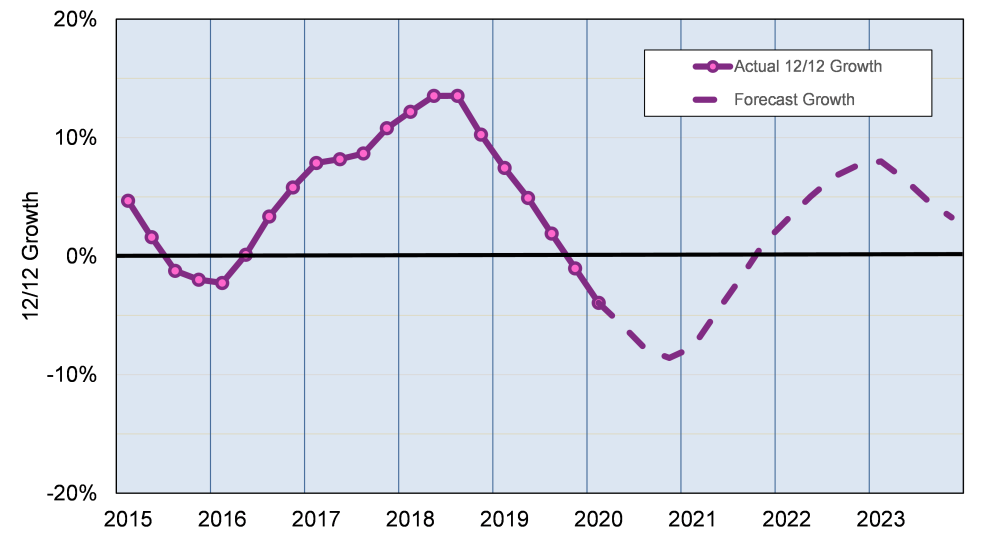

As we enter the second lockdown in November 2020, I was wondering what to write for this Journal that would boost the spirits of those in the electronics industry in these trying times. Looking for inspiration, I revisited the words I wrote for this Journal at the end of 2015 and found that I finished my article on the following note: “As we enter 2016, the outlook is similar to or a small improvement on 2015. European electronics production peaked on its current growth cycle in 2015 and low growth is expected in 2016 with the next peak around 2018/2019………… The impact of all this on circuit board companies is low single digit growth in 2016 with the next round of growth peaking in 2017/2018. Something to look forward to!” Fast forward to 2020 and take a look at Chart 1 below. This shows the 12/12 growth curve representing electronics production in the UK since 2001. Underlying the red 12/12 curve are the monthly growth variations (growth compared with same month in previous year). This electronics production data, sourced from the ONS, represents the market for PCBs in the UK and includes components, electronics and optoelectronics (19% of the data represents components, PCBs, assembled boards, non-electronic and optical products). As can be seen, 2016 was indeed a better year than 2015 and growth peaked in early 2018. Surprisingly, the Brexit vote in 2016 appeared to have little impact on the buoyant industry. Chart 1: 12/12 Growth UK Electronics Industry 2001-2020 2020 has been a whale of a rollercoaster with a downward trend. A weakening Q1 was followed by what should have been a stronger Q2 fulfilling the pandemic-driven demand for ventilators and other equipment by the medical sector. However, this was offset by loss of orders in Q2 and thereafter as the civilian aerospace sector contracted with reduction in air travel as well as loss of confidence across most other markets. The global effects of the pandemic also resulted in a contraction of export orders further exacerbating the situation. Where we are now is hopefully a bottoming out of the growth curve at somewhere between -7% to -10%. By Q3 some manufacturers were seeing a return to near normality despite the necessary Covid-safe precautions. The second lockdown in UK and across Europe is now likely to protract uncertainty and the commercial aerospace sector will take several years to recover. However, implementation of 5G and the emerging market for electric vehicles will help to contribute to positive growth. The availability of Covid-19 vaccines in early 2021 should also speed the return to normality. The outlook for the industry is therefore a slow recovery through 2021 followed by positive growth in 2022 and 2023 of around 5% per annum, as shown in Chart 2 below. There is light at the end of the tunnel! Chart 2: Actual and Forecast Growth for UK Electronics Industry |

| Go back to Contents |

|

Section 6 |

Institute of Circuit Technology Technical Webinar19th November 2020

Pete Starkey |

|

|

With its regular programme of physical seminars and symposia on hold, the Institute of Circuit Technology went virtual this year and presented a webinar of three technical papers, organised by Technical Director Bill Wilkie and introduced by IPC Chair Emma Hudson. Dr. Dave Shaw from A-Gas Electronic Materials introduced an innovative transparent PCB material. The market for transparent conductive films was currently dominated by indium tin oxide (ITO) for both glass and flexible substrates. The main limitations of ITO were its brittleness and the cost of imaging. Its dominance was likely to continue on glass, but it would probably be displaced on flexible substrates by materials with better flexibility, formability, and transparency, imageable by lower-cost alternatives to laser ablation. The current materials choice was poly(3,4-ethylenedioxythiophene) (PEDOT), silver nanowires, and metal mesh. Carbon nanotube technology offered newer alternatives, and Dr. Shaw discussed a hybrid ink-based on carbon nanotubes and silver nanowires, which offered technical and functional benefits. On a cost comparison with ITO, although the material itself was more expensive, once imaging was taken into account, substantial savings could be realised. Regarding fabrication and processing requirements, existing PCB and printed electronics shops had all the basic facilities. Two imaging routes were demonstrated: direct imaging by screen printing and curing, or print-and-etch on film pre-coated with silver nanowires, using the carbon nanotube ink as a resist that remained in place as a functional part of the end product and therefore did not need stripping. Only a mild ferric nitrate etchant was required. The result was excellent flexibility, high transparency, and very low electrical resistance. Alternatively, the carbon nanotube ink could be screen printed as an etch resist onto a copper metal-mesh film then etched to produce a patterned transparent conductive film. Dr. Shaw showed several examples of transparent flexible circuits, as well as transparent antennae for 5G, transparent touch sensors, transparent lighting films, and transparent heaters for automotive applications. Numerous additional opportunities for growth and application diversification were being explored. |

|

Dr. Jonathan Swanston, CTO of Jiva Materials, gave an update on the U.K. government-funded ReCollect project for the efficient manufacturing of recyclable composite laminates for electrical goods. Through its Inquiry Into Electronic Waste and the Circular Economy, the government’s Environmental Audit Committee was exploring how the U.K. could reduce its environmental impact, create economic opportunities, and maintain access to critical materials by better managing and minimising its e-waste. The ReCollect Project aimed to reduce the impact of the e-waste stream using naturally derived products. Jiva was the inventor of Soluboard—a patented, competitively priced, and fully recyclable printed circuit board substrate—and was leading the specification and development of the thermoplastic input materials as well as the conversion of the substrates into working circuit boards. The unique attribute of Soluboard was that it dissolved in hot water, yielding biodegradable and non-toxic products. Components were recoverable and recyclable. A Soluboard circuit was claimed to have 60% lower carbon footprint than a standard PCB. Jiva was targeting 5% of the market sector for single and double-sided boards in household appliances by 2027. Testing and preparation of the material safety datasheet were proceeding, and guidelines for additive and subtractive processing were being developed. Electrical properties were comparable with FR-4 and CEM1, thermal conductivity was similar to FR-4, mechanical properties similar to CEM1, and flame retardancy in line with UL94V0. |

|

Chris Wall, technical director of Electra Polymers, gave a detailed overview of the state-of-the-art in inkjet solder mask. He categorised the different types of solder mask by patterning method: liquid photoimageable, whether by contact printing or LDI, he classified as indirect; and screen printing and inkjet printing he classified as direct, meaning that the pattern was placed directly where it was needed, rather than being coated, then imaged and developed. Inkjet techniques were categorised as continuous or drop-on-demand—the type used for solder mask application, and drop-on-demand was further categorised by print-head type; thermal or piezoelectric—the principle generally used. Good print performance of a particular ink depended on collaboration between the ink and equipment suppliers. A wide range of proven equipment was currently available, and ink formulation was becoming a mature technology. Inkjet solder mask offered several advantages: there was no artwork—the image was created directly from the CAM data, so it was repeatable and capable of being dimensionally optimised to compensate for distortion of the circuit image. The material was effectively 100% solids, so there was no solvent emission, the fully-additive process meant there was no material wastage, and the process had the potential for high throughput as well as a significant reduction in process steps compared with the liquid photoimageable process. Wall discussed, in general terms, the different types of print-heads and how they influenced the properties of the drops they generated before delving into the physics of stable drop formation in terms of drop velocity, ink density, nozzle diameter, ink viscosity, surface tension, and the relationships between them. He demonstrated the mathematical derivation of Reynolds number, Weber number, Ohnesorge number, and the Fromm Z parameter. By plotting Ohnesorge number against Reynolds number, he showed how the optimum characteristics of a printable ink could be predicted. Clearly, ink formulation involved more than trial-and-error mixing of cans of green paint! Once the perfect droplets had been generated and directed to the required location on the circuit board, there was a further set of considerations to take into account: wetting and controlled flow, followed by fixing in position. Print-strategy optimisation involved specialised surface treatments to minimise droplet spread, different print-profile recipes to suit different board designs, and pin-curing to fix the droplets in place. After printing, there was typically a high-intensity UV cure, followed by a final thermal cure. In the context of wetting and spreading, Wall discussed the physics of contact angles and the effect of substrate surface treatments and showed cross-sections of solder dams between component pads. Multi-layered print profiles could be used to create dams around pads and prevent thinning on track edges, and to build thickness selectively. Electra’s proprietary inkjet solder masks qualified to IPC-SM-840E Class H and T, and UL94V-0, and had been proven to endure severe thermal storage and thermal shock testing. |

|

Emma Hudson moderated a lively question and answer session before bringing the webinar to a close and thanking presenters for their contributions, delegates for their attention, and especially Bill Wilkie for his expert organisation of an excellent event. Pete Starkey I-Connect007 |

|

Section 7 Paper 3 |

A Second Life for Electric Vehicle (EV) Batteries Martin Goosey |

|

Envaqua Research Ltd. |

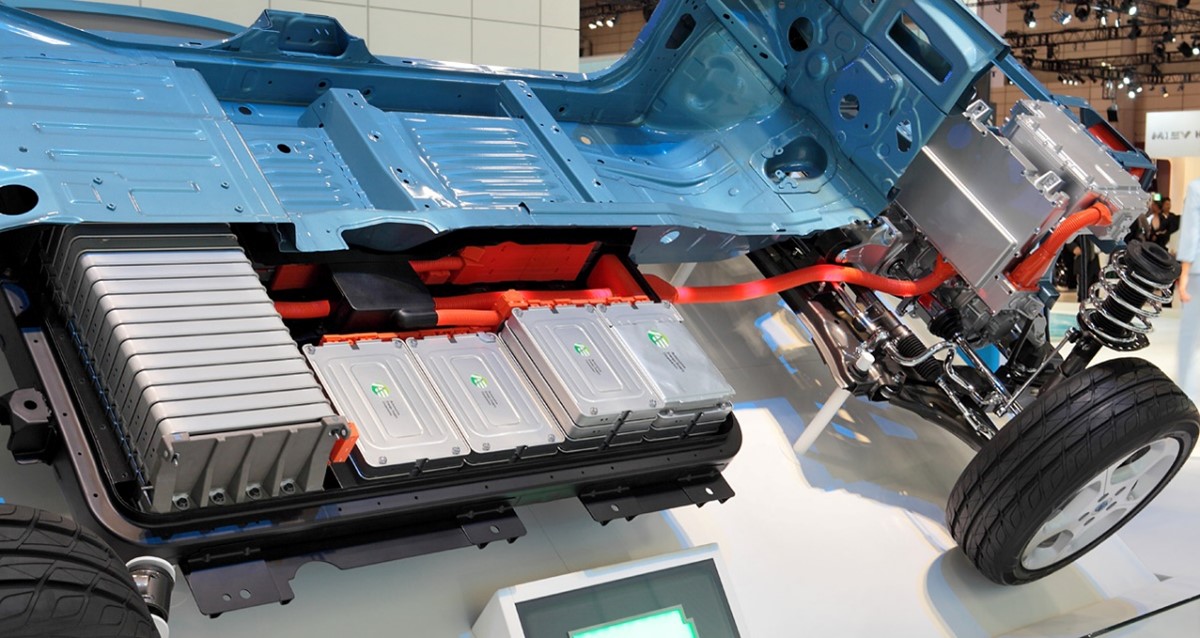

At the ICT Spring Conference held in Meriden earlier this year, I gave a presentation on the re-use and recycling opportunities for electric vehicle batteries. While it was not directly related to printed circuit boards, the implications and challenges of producing high performance control and monitoring circuitry that can be built into the expensive and complex battery assemblies are clear; batteries must perform reliably and optimally in harsh environments for many years. This article builds on one aspect of my Meriden presentation and it covers the possibility of using end of first life electric vehicle batteries in secondary applications before they are recycled. The transition to electric transport is being driven by the need to address important issues such as global warming. Consequently, it is vital that the maximum benefits of battery propulsion are utilised and they include optimising activities such as charging and discharging throughout the whole life cycle of the batteries used in electric vehicles. From a sustainability perspective, one key contribution can be made by extracting as much use as possible from an EV battery before it reaches the end of its life and is recycled to make new batteries. This makes even more sense when the numbers of batteries becoming available is taken into account. It has been predicted that, by as soon as 2025, there will be around 3.4 million of these batteries available globally and that by 2040, approximately 560 million electric vehicles will be in existence. For a typical electric vehicle, the battery life may be up to ten years, yet there could be several more years of further use potential in secondary applications. Thus, when the performance of an EV battery has dropped to the point where it is no longer suitable for use in a vehicle, it should not mean that it is automatically consigned to recycling/materials recovery. Although it will have reduced performance, it is also possible to identify less-demanding uses, where the lower capacity is not a significant issue. Extending their lifetimes makes batteries more sustainable and goes some way to adopting an enhanced circular economy approach; it reduces demand for new batteries, thereby reducing the negative impacts of battery production. Indeed, the idea of encouraging the secondary use of ex-EV batteries is so important that the subject has been taken up by the European Commission. The EC has reached an innovation agreement with several European manufacturers to adopt the objective of promoting the reuse of lithium-ion batteries before they are subsequently recycled.

An important specific example of one of these uses for second life batteries is in energy storage and supply balancing at the domestic level. Additionally, second life batteries are now being used for energy storage directly linked to the enhanced charge management of electric vehicles in an attempt to reduce demand at peak times, thus preventing potential overloads on electricity supply grids. There are already a number of products commercially available for energy storage, including ‘Offgen’ from Aceleron, ‘PowerWall 2’ from Tesla and the ‘Powervault 3’ from Powervault.

The ‘Offgen’ and ‘Powervault 3’ battery storage units are both designed and assembled in the UK and are specifically aimed at the storage of solar or off-peak electricity in residential and commercial buildings. The company Powervault found that, by using lithium-ion batteries recovered from Renault EVs instead of new ones, it was possible to reduce the cost of one of its smart battery units by 25%. The Powervault 3 is available as the greener Powervault 3 eco version, which uses recovered and tested second life batteries. Outside the UK, there have been numerous other examples of recovered batteries being reused to store electricity. For example, a second-life energy storage system was developed by a team at the University of California’s Davis Green Technology Laboratory. Approximately fifteen ex-Nissan Leaf battery packs were assembled in a shipping container to give a unit with a 300 kWh capacity. This was used as a power source to reduce the peak energy demand and carbon footprint of a winery, brewery and food processing complex. By finding secondary uses like this, it is also possible to reduce overall energy costs, thus providing benefits to both consumers and electricity providers through renewable energy integration and regulation of energy management. However, it should be noted that only some energy storage products use second life lithium-ion batteries, as manufacturers often prefer to use brand new cells. Using second life batteries is potentially a way of offering a product at a reduced price compared to the same model using new batteries, but there may also be potential longer-term reliability issues and thus shorter warranties. Tesla prefers to directly recycle its batteries to make new ones and does not use ex-EV batteries in its PowerWall products. The reasoning is that an EV battery will reach end of first life after around 8 to 10 years. By this time, Tesla suggest that both the battery capacity and pricing will not be comparable with the latest technology, i.e. it will be more cost effective to use new batteries. Although there will undoubtedly be a growing demand for battery-based energy storage systems, there are still some questions about the overall benefits of using second life ex-EV batteries, as highlighted by Tesla. In order to be able to reuse EV batteries in second life applications, it is necessary to have detailed information about the condition of each battery and this requires a level of testing that adds to the costs. If such information could be recorded via, for example, the original battery management system and by using more modular battery management approaches in the new units, this might become less of an issue. There are also broader concerns about the overall cost-benefit of using battery-based storage at the consumer/domestic level. The situation is rather complex, as it depends on a number of variables including the cost of power from conventional suppliers via an electricity grid. Using renewables such as solar and battery storage can be significantly more expensive, so it is probably likely to be more of a benefit to off-grid users, or those living in remoter areas, at least initially. While there is clearly a need for more energy storage capacity, especially as the shift to renewable energy expands, and as the development of more intermittent sources of energy accelerates, the area is relatively new and will need considerable support until it is better established. Second life batteries could provide a lower cost option compared to new batteries. It was, therefore, disappointing to see that, according to the European Association for Storage of Energy (EASE), Europe’s energy storage growth activity was reduced during 2019 due to a slowdown in large-scale storage schemes for energy from renewable sources. The downturn was particularly related to projects that connected directly to energy grids, and which were designed to store renewable energy when solar and wind generation was less available. At the time of writing, there was another negative factor in the form of the Covid-19 pandemic. Depending on its duration and overall impact on the global economy, it seems likely that it will further reduce the implementation of government policies aimed at supporting energy from renewable sources and thus result in fewer battery installations, at least in the short term. Nevertheless, although the situation is rapidly evolving, it is clear that there are circular economy and sustainability benefits to keeping former EV batteries in use for as long as possible. There are various less-demanding applications that can utilise ex-vehicle batteries for a number of additional years after first use and before they need to be recycled. However, as with the whole story around the EV-battery lifecycle, the situation is complex; there are even those who are testing and reusing EV batteries in vehicular applications, i.e. for lower cost replacement batteries to keep older electric vehicles on the road. It will be interesting to see how the opportunity develops over the next twenty years as battery production, use and the need for recycling increase dramatically.

While the potential to reuse EV batteries is important from an environmental and sustainability perspective, it might be less immediately clear what relevance this has to the electronics and printed circuit board industries. However, if one considers the construction of an electric vehicle battery, it soon becomes obvious that there are several critical key electronic assemblies such as the battery management system, which acts rather like a brain, controlling and optimising the performance of the battery under widely varying operating and recharging conditions. If batteries are to be used for periods of fifteen years or more, it is essential that their electronics have high reliability. A car’s battery management system must be able to reliably and efficiently control these high-voltage battery packs, carefully balancing the voltages of individual cells, or groups of cells, while also monitoring their performance. There is also a need for control and monitoring electronics for individual groups of cells within the battery pack. This is typically achieved with what are known as block monitoring boards. Groups of cells need to be monitored and kept in balance with each other. These boards are able to monitor the voltage and temperature, both of individual blocks of cells and the inter-block interconnection temperatures. The block monitoring boards also provide an additional safety feature in terms of identifying problems before they can become serious. Overall, these sophisticated electronics assemblies must be able to operate reliably and accurately under what are considered harsh conditions, including exposure to mechanical shocks and vibrations and over a range of temperatures. All this has to be achieved with circuitry and electronics that has to be fitted into a very limited space, close to the batteries and where there is likely to be good deal of thermal cycling. The electronics, therefore, need to have high reliability over what is likely to be an extended service life. The provision of these high reliability components will thus be the key to optimised battery performance and battery longevity. How this is achieved is beyond the scope of this article, but it could be covered in more detail in a future one. For now, the key message is that there is a real opportunity to extend the operational lifetimes of electric vehicle batteries well beyond the point where they are no longer suitable for use in the cars themselves. By using them in secondary energy storage applications it is possible to maximise their utility before they are consigned to recycling, thereby reducing their environmental impacts and enabling the EV battery industry to be more sustainable. Secondary use of EV batteries in energy storage could play a major role in helping to shape the future of our electricity generation, distribution and use. Martin Goosey |

|

Section 8 Paper 4 |

A Market Research Project in Industrial Applications for a University Developed Technology - SMMF Sofya Danilova |

|

Sofya Danilova Postdoctoral Research Fellow - Coventry University |

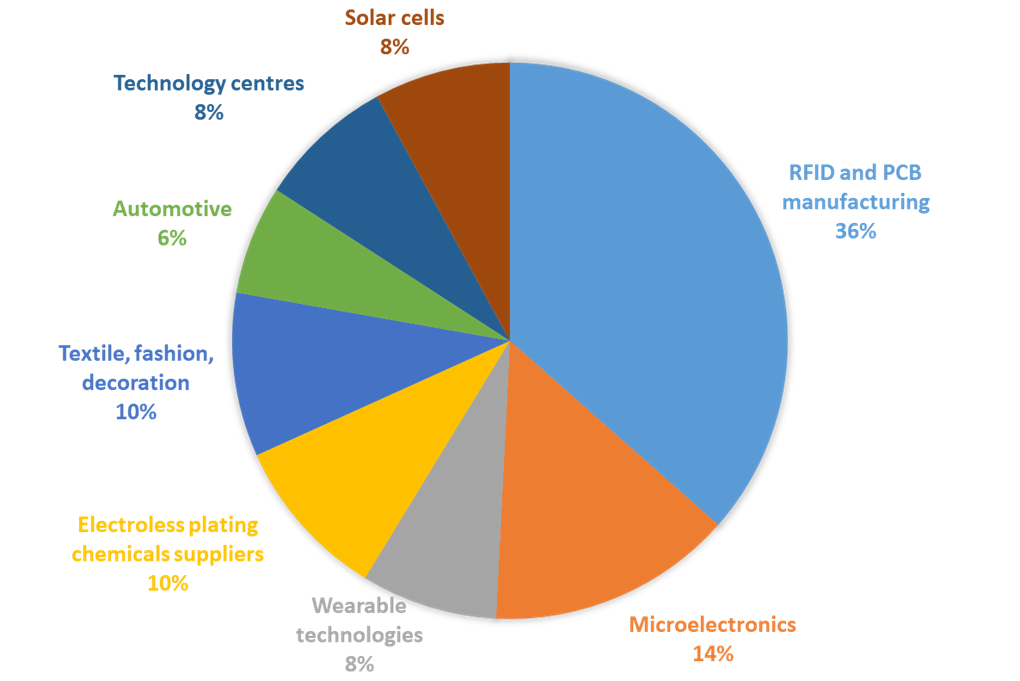

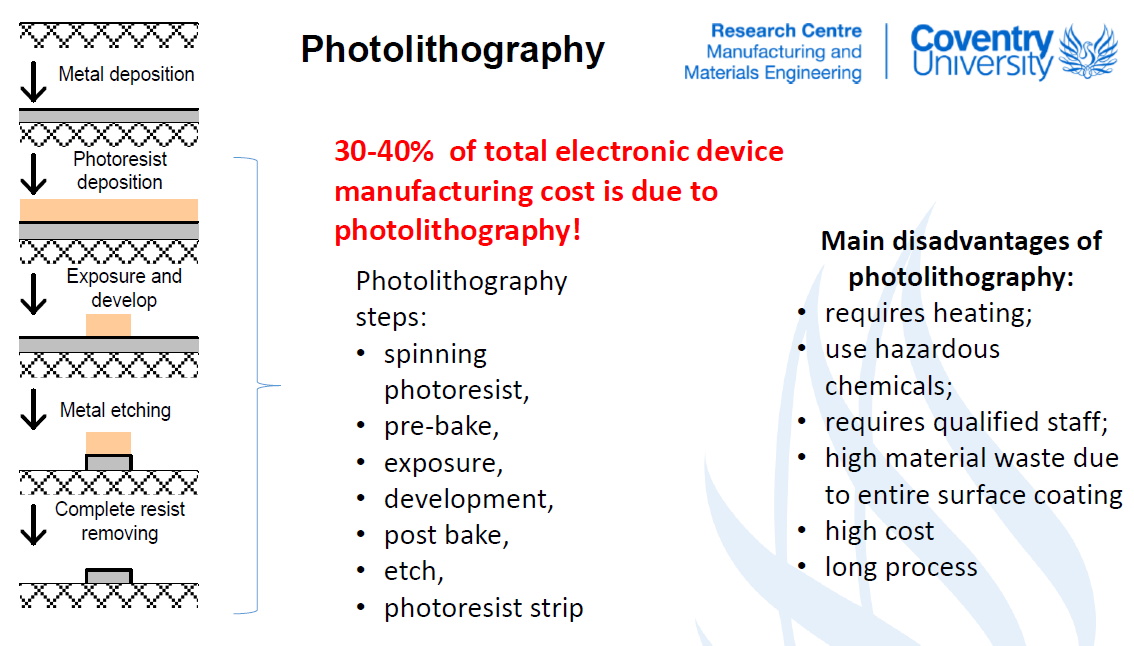

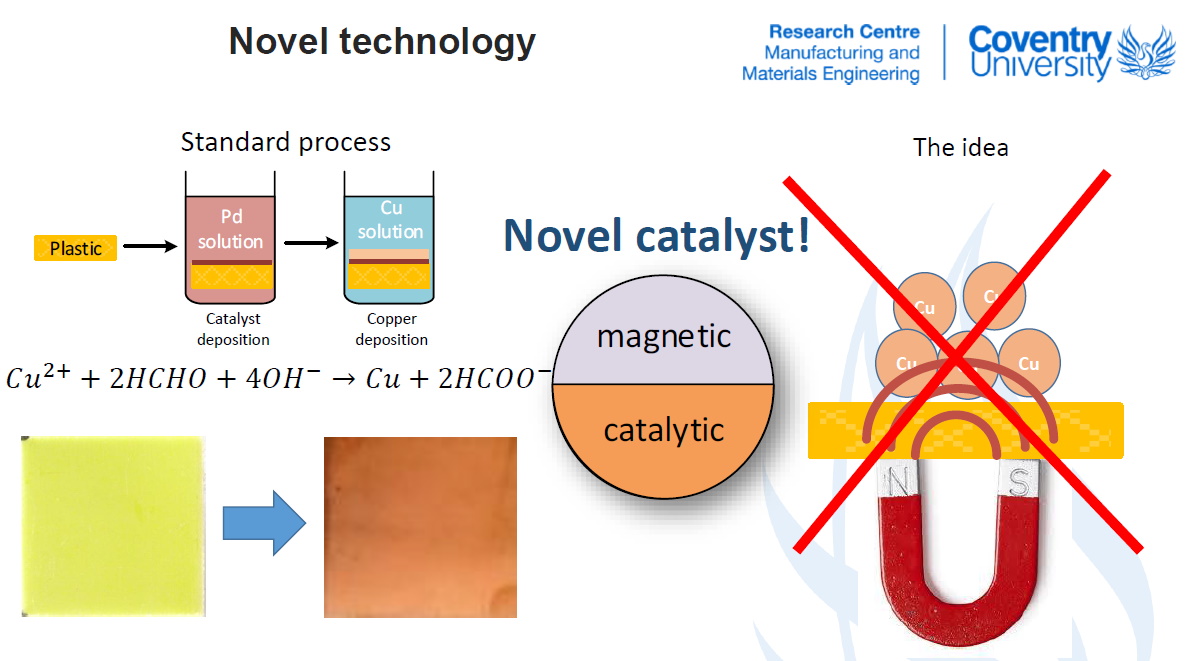

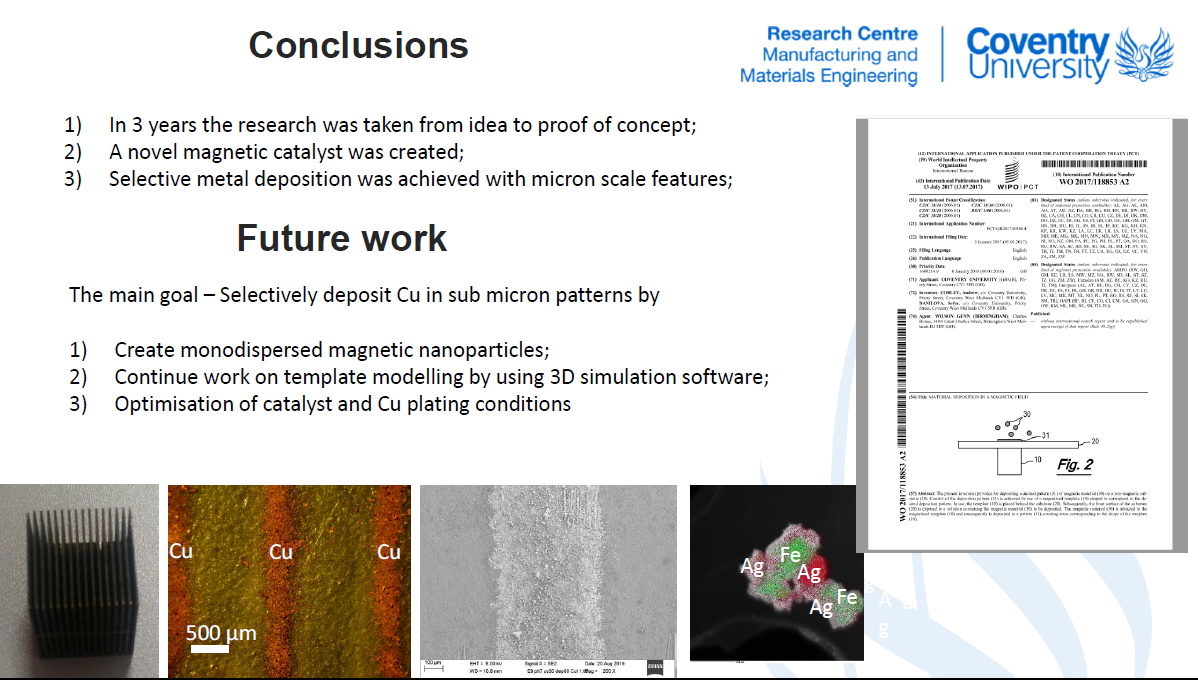

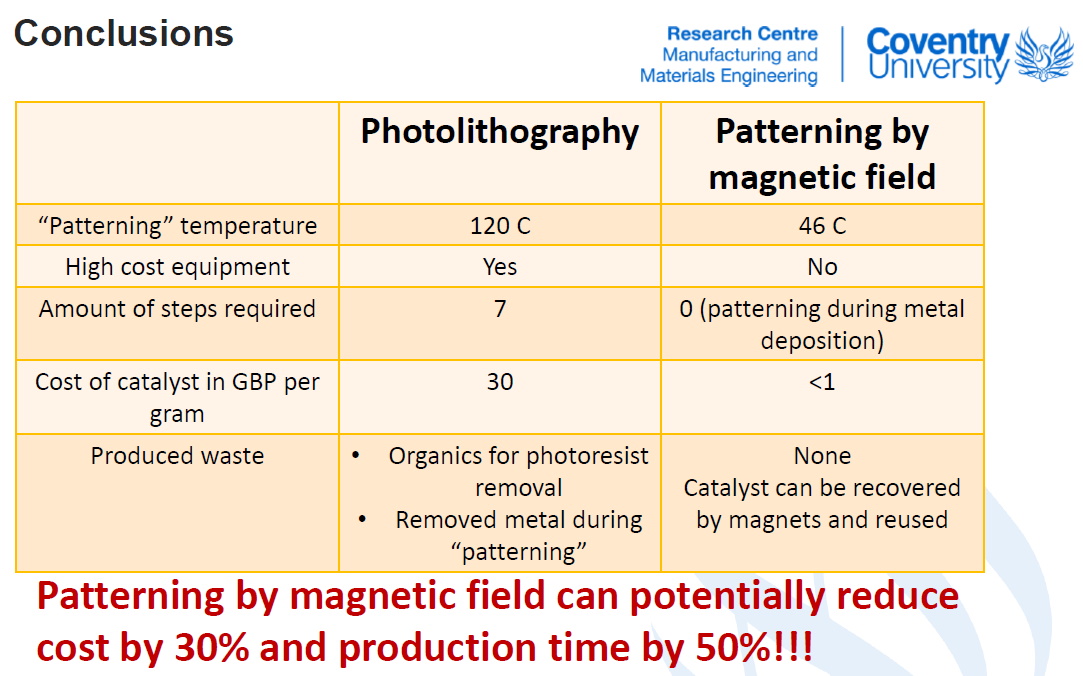

Production of selectively metallised non-conductive material is one of the key processes in PCB and antenna manufacturing. Many industries are looking for alternatives to the lithography process: with some using ink-jet printers or lasers to achieve this. At Coventry University we developed a novel approach of Selective Metallisation which uses a Magnetic Field (SMMF). We direct catalyst to the area which requires metallisation and subsequent electroless Cu deposition only occurs at the regions with catalyst. In our approach we replaced Pd with a Ag/Fe-based catalyst to make it magnetic. So far, we have proven the concept and deposited parallel lines of Cu with a thickness 350 um. This research was the main theme of my PhD thesis at Coventry University. Aware of the potential applicability of the research, I decided to conduct market research (which was funded by iCURe Innovate UK) during which I aimed to meet industries to get feedback on the subject. I experienced incidents of miscommunication with solar cell manufacturers when conducting my own market research. Many academic researchers assured me there are applications for my technology in the solar cell industry – next generation solar cells require low temperature methods of conductive track deposition. However, all my attempts to arrange meetings with solar cell companies were unsuccessful. Without a platform for free exchange of ideas between industry and academia, it remained unclear what the cause of these miscommunications were. My face-to-face communication with the PCB community was much more productive. I believe it was not an accident that many of the people from industries with whom I made contact and who provided feedback were members of ICT or were introduced by them. At the end of the first ICT seminar that I attended, I had one of the most productive conversations of my whole PhD, which was about my research with MD’s of the PCB companies. Fig 1: Sectors approached during the ICURE journey to pitch SMMF technology. Overall, the outcome of the market research was that novel applications for the technology were not identified, although the process helped me to receive feedback on the research and initiate further industrial collaboration with PCB manufacturers. However, the main thing which this market research highlighted to me is the need for the initiatives such as this, funded by iCURe Innovate UK and supported by the ICT, to bring industries and Universities together for more productive collaboration. |

|

Section 9 Research Paper 1 |

Selective Metalisation Using a Magnetic Field Technology Sofya Danilova |

|

Sofya Danilova Postdoctoral Research Fellow - Coventry University |

Selective electroless copper plating on a non-conductive substrate via magnetic field application (SMMF)

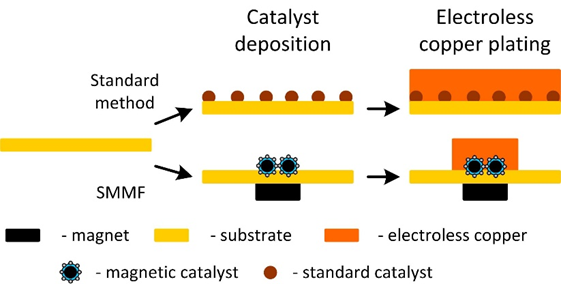

Fig 1: Comparison of standard electroless plating procedure and Selective Metalisation Using a Magnetic Field (SMMF)

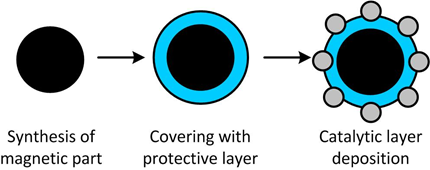

Fig 2: Scheme of magnetic catalyst synthesis

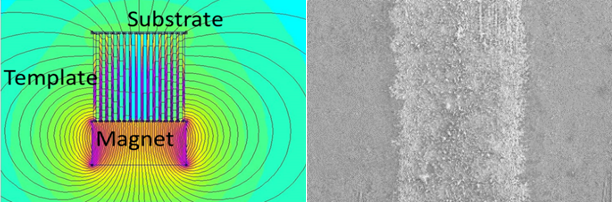

Fig 3: Simulation of the magnetic template (left), a line of selectively deposited copper made by SMMF (right)

Fig 4: Existing uses of the established technology of selective metalisation in electronics

Fig 5: The photolithographic steps used in the subrtactive process

Fig 6: The SMMF concept to depost metal under the influence and constraint of a magnetic field

Fig 7: Conclusions and future work proposals to establish a viable selective deposition process

Fig 8: Advantages of SMMF are cost reduction, time savings and low environmental impact. |

|

Section 10 Research Paper 2 |

Inkjet Printing of Polyacrylic Acid-Coated Silver Nanoparticle Ink onto Paper with Sub-100 Micron Pixel Size |

|

Arunakumari Mavuri Engineering, Faculty of Science, University of East Anglia

Andrew G. Mayes School of Chemistry, University of East Anglia

Matthew S. Alexander Engineering, Faculty of Science, University of East Anglia |

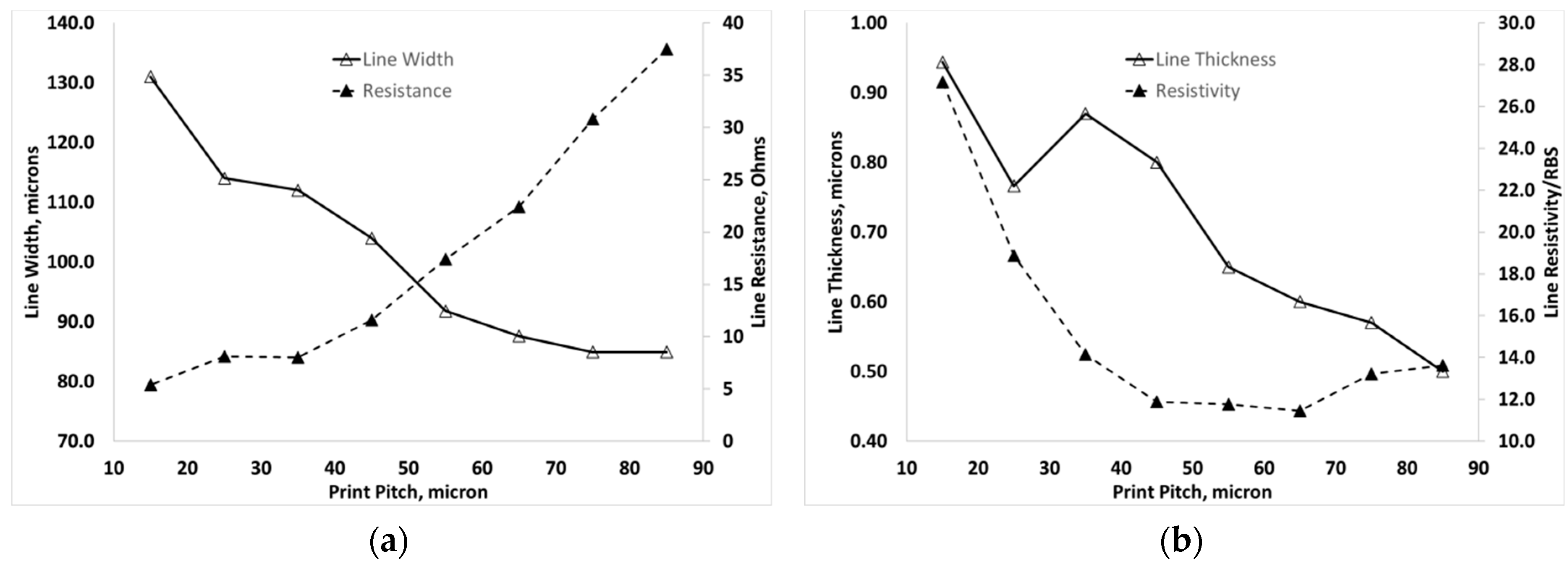

Abstract Printed electronics (PE) technology shows huge promise for the realisation of low-cost and flexible electronics, with the ability to pattern heat- or pressure-sensitive materials. In future developments of the PE market, the ability to produce highly conductive, high-resolution patterns using low-cost and roll-to-roll processes, such as inkjet printing, is a critical technology component for the fabrication of printed electronics and displays. Here, we demonstrate inkjet printing of polyacrylic acid (PAA) capped silver nanoparticle dispersions onto paper for high-conductivity electronic interconnects. We characterise the resulting print quality, feature geometry and electrical performance of inkjet patterned features. We demonstrate the high-resolution printing, sub-100 micron feature size, of silver nanoparticle materials onto flexible paper substrate. Printed onto photo-paper, these materials then undergo chemically triggered sintering on exposure to chloride contained in the paper. We investigated the effect of substrate temperature on the properties of printed silver material from room temperature to 50 °C. At room temperature, the resistivity of single layer printed features, of average thickness of 500 nm and width 85 µm, was found to be 2.17 × 10−7 Ω·m or 13 times resistivity of bulk silver (RBS). The resistivity initially decreased with an increase in material thickness, when achieved by overprinting successive layers or by decreasing print pitch, and a resistivity of around 10 times RBS was observed after overprinting two times at pitch 75 µm and with single pass print pitch of between 60 and 80 µm, resulting in line thickness up to 920 nm. On further increases in thickness the resistivity increased and reached 27 times RBS at print pitch of 15 µm. On moderate heating of the substrate to 50 °C, more compact silver nanoparticle films were formed, reducing thickness to 200 nm from a single pass print, and lower material resistivity approaching five times RBS was achieved.

|

| Go back to Contents |

|

Section 11 |

PCB Fabricators Group - a Benefit to all who Fabricate PCB’s in the UK. |

|

Matthew Beadell Technical Director, |

The fabricator group is now into its second year and is still going strong with most of the UK PCB Fabricators involved, the attendance is good with two thirds of the group attending every meeting (quarterly) – currently on teams due to Pandemic. The meeting includes an update on B2B PCB Statistics from Francesca Stern, these figures are included in the yearly subscription cost and results shared with the group. The group has been setup to allow the UK fabricators to discuss initiatives to assist the industry and allow knowledge transfer between the members. Current projects are looking at Disaster recovery, Industry training courses, Equipment servicing, Grants / funding and Government Industry representation - followed by an in-depth ‘round table’ discussion. We believe the success of the group is in part due to the openness of its members and willingness to assist all companies within the group, irrespective of size. The group is always looking for new fabricators to join and feel it is especially important to be part of a group at this turbulent time in our industry. |

|

Section 12 |

Industry News |

|

12.1 Adeon |

MKS Sees Strong Early Market Adoption in Asia for its Newest HDI PCB Laser Manufacturing Solution MKS are a market leader in flex PCB laser drilling solutions. The new Geode system is optimized to process rigid HDI PCBs and package substrates widely used in consumer electronics, such as smartphones and other handheld devices. Building on MKS’ technology leadership in laser processing for flexible printed circuits, Geode’s new CO2 laser technology and control capabilities deliver breakthrough performance. Its superior throughput, refined power control and small system footprint meet the needs of high-volume PCB manufacturers. The Geode system delivers many benefits for high-end applications, such as 5G. The Geode system’s higher drilling throughput and accuracy, smaller footprint and lighter weight enables capacity expansion with much more flexibility. The system can process a broad range of applications and materials. Read more...... |

|

12.2 Exception PCB |

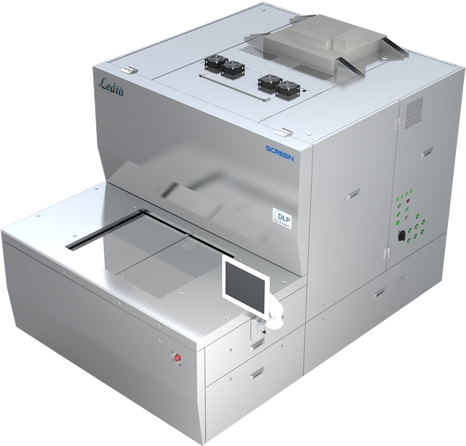

Exception PCB purchases Ledia Direct Imager

One of the largest dedicated time and technology PCB manufacturers in the UK, has purchased a Ledia Direct Imager from Ucamco. To great satisfaction of all parties involved. More specifically, the direct imager is a Ledia 6 3-head 3-wavelength type. As the name suggests, the Ledia’s unique UV-LEDs light source combines three different wavelengths simultaneously. The wavelength ranges from 350nm to 440nm to diffuse the energy optimally throughout the resist or solder mask. The user can tune each wavelength’s power individually for optimal results on or each material. The result is high throughput and unrivalled quality – 50µm solder mask dams without undercut. Read more.... |

|

12.3 Eurotech |

EuroTech invest in IPC4761 Type VII capped vias

EuroTech’s purchase of Epoxy Via Plugging and Planarizer PD50® systems will see a further increase in the company’s technical capability. The equipment, which was purchased as part of an ongoing investment programme, has been installed into EuroTech’s Exmouth facility. |

|

12.4 ParaChem |

Waste Framework Directive (WFD) Compliance with the Waste Framework Directive (WFD) is imminent, you must submit your SVHC dossiers to the ECHA by 5th January, 2021. Are you aware that submissions to the European Chemicals Agency SCIP (Substances of Concern in articles as such or in complex objects (Products)) database is a legal requirement for any products supplied into the EU from 5th January 2021. The duty is made under the Waste Framework Directive (WFD) and is basically the same as the disclosure duties under REACh, i.e., relating to Substances of Very High Concern (SVHCs) present in finished products at a concentration of greater than 0.1% w/w. The difference in this new requirement is that you must notify ECHA rather than just your customers. The technical information you need is produced by ParaChem’s ReachWARE® compliance tool at our website (www.parachem.co.uk). As current subscribers will know, ReachWARE® produces reports that identify any SVHCs present in your finished products at greater than 0.1% w/w. You can then use the reports to compile and submit your dossier data to ECHA via the ECHA Cloud Service at https://echa.europa.eu/scip . If you are not currently a ReachWARE® subscriber, you can set up an account very easily through our website and be producing reports within a few days. The registration process and instructions for uploading your dossier are both described in the ECHA attachment.here... For further advice or information for current or prospective subscribers, please contact at

Colin Martin CChem MRSC Senior Partner ParaChem Consulting Chemists T:02392 704171 M:07774 179881 www.parachem.co.uk |

|

12.5 Merlin |

Merlin Circuit Technology invests in the Lead Free Quicksilver HASL Machine

The lead free process has a number of challenges relating to the elevated operating temperatures and the absence of lead such as achieving the required coating thickness and flatness requirement without increasing the intermetallic layer – so as to form a properly wetted copper surface. Read more....

|

|

12.6 Ventec |

Ventec - High Speed Material Option with Thin Film Resistor Foil

For enhanced high-speed signal-handling performance required by the world's most demanding high-frequency Printed Circuit Board applications, Ventec International Group has launched a laminate option to its tec-speed 20.0 glass-reinforced hydrocarbon and ceramic laminate cladded with thin-film resistor material from Ticer. Read more....

|

| Go back to Contents |

| Section 13 |

Members News |

|

13.1 Chris Wall |

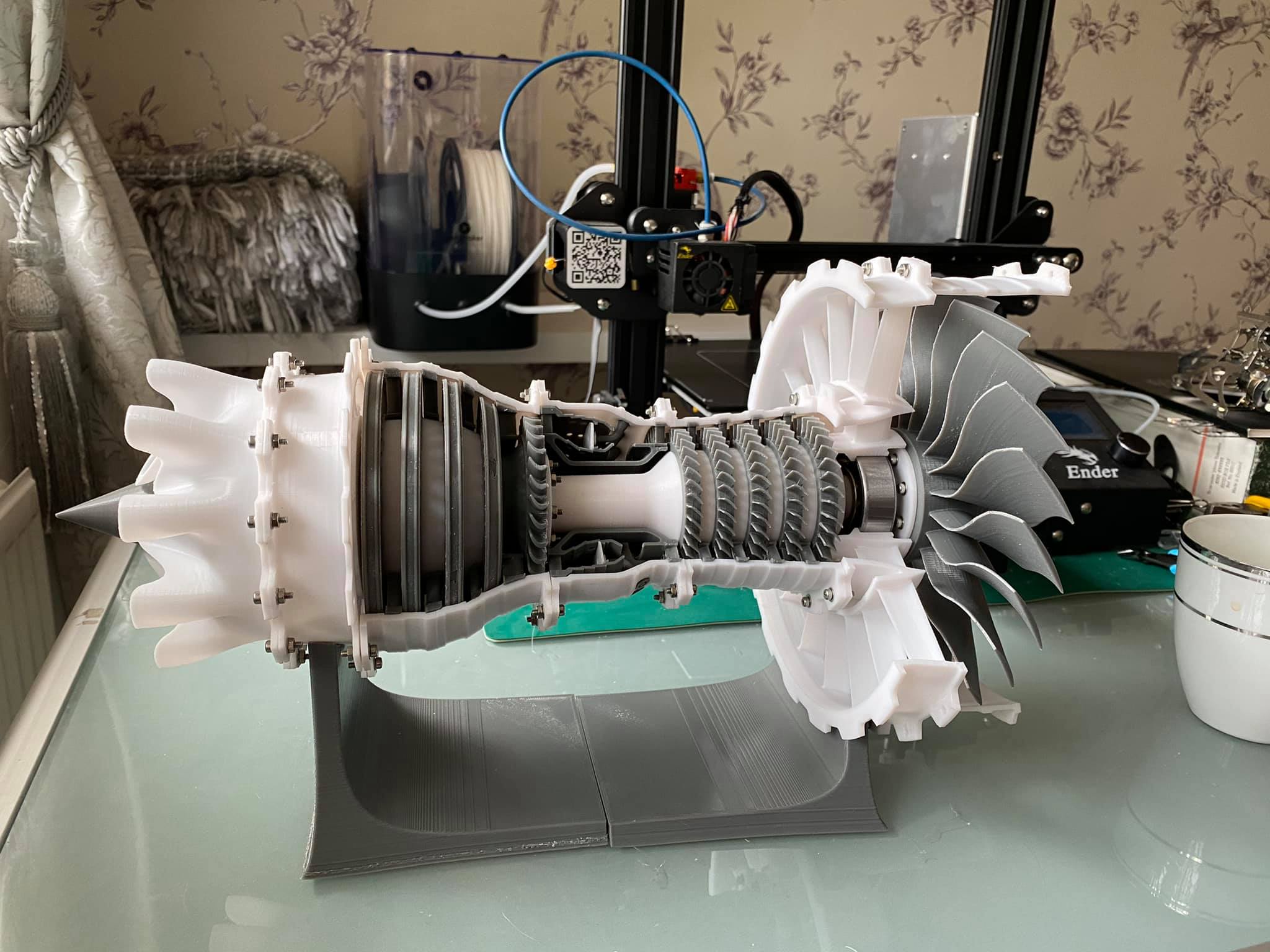

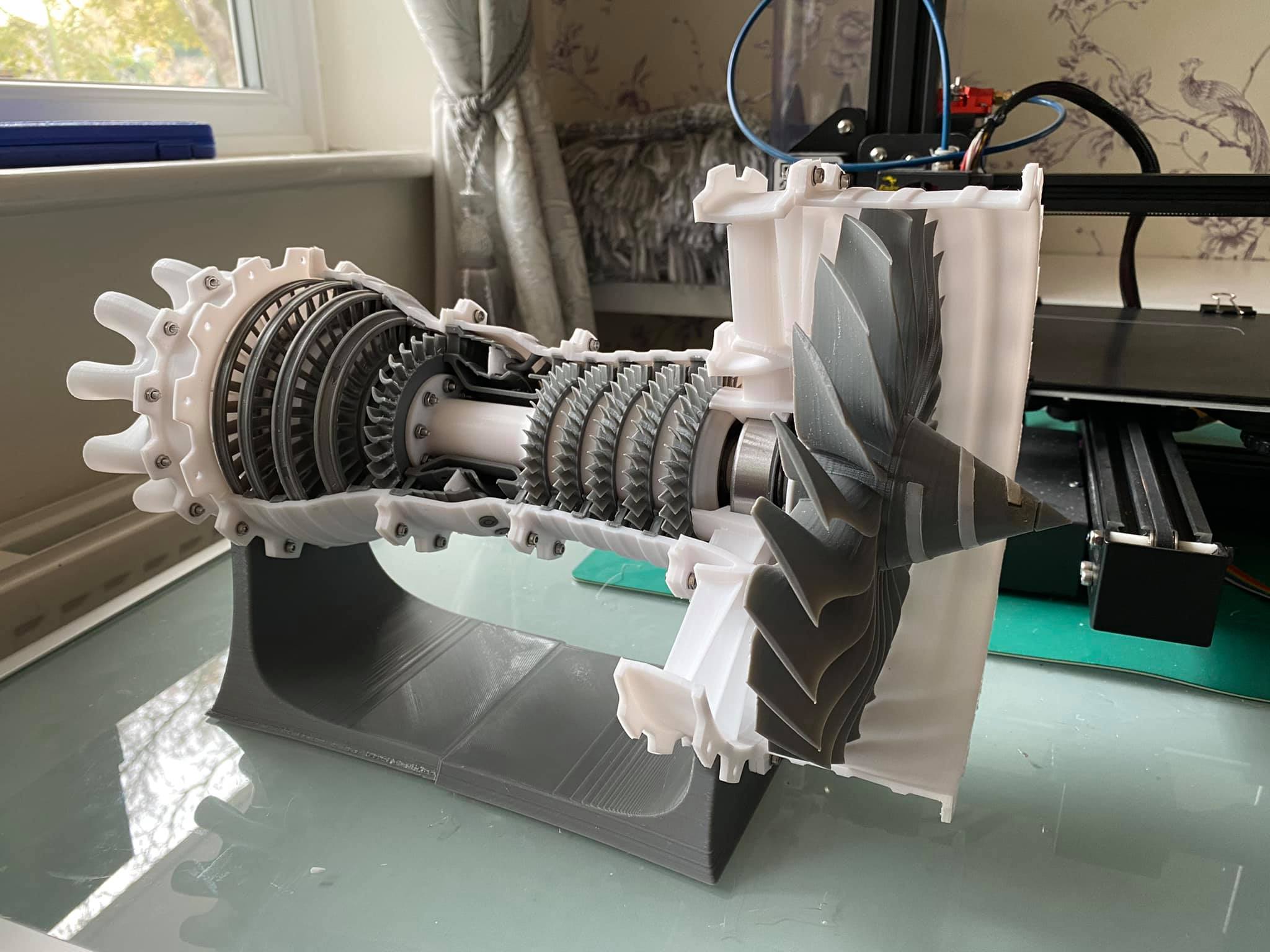

Jet Engine from 3D Printer Chris Wall - Electra Polymers Ltd Chris has been honing his printing skills and succsesfully completed the construction of a cut-away model of a jet engine. This took about 3 months and the final assembly did not quite turn as freely as expected but met the objective and is super impressive.

Fan stator casing

The completed cut-away jet engine |

|

13.2 Phil Danter |

Cycle 300 for Cancer Research UK Phil Danter - Exception PCB

Throughout September our IT Manager, Phil Danter took on the challenge of cycling 300 miles to raise money for Cancer Research UK. Phil rode the roads of Tewkesbury and surrounding areas, the longest ride in a single day was nearly 26 miles. Phil Said “The 300 miles did seem to fly by quite quickly, mainly due to the better than average weather and longer days. My wife and work friends… Read More » |

| Go back to Contents |

|

Section 14 |

Membership News |

|||

|

14.1 |

Membership Update |

|||

|

Technical Director and Membership Secretary

|

In 2005, the then Membership Secretary, Bruce Routledge started a new numbering system for Members. First in, at 10000 was Tony Hunt, East Ender, West Ham Supporter and well known in the Industry as a Technical Sales Representative for Morton. Tony was a metallurgist, cutting his pcb teeth at Marconi Avionics and B&T Circuits before a 16 year stint at Morton. The Millennium saw in many changes and Tony did really well, moving to Stevenage Circuits as General Manager. Quite a coincidence that this month we celebrate our 500th grading at 10500 with Jonathon Meadows also of Stevenage Circuits, who joined as New Business Development Manager.

Blast from the past. Adam Wellington remembered the following from the 1980’s for his CV |

|||

|

14.2 |

NEW MEMBERS |

|||

| Memb. No. | Name | Company | Grade | |

|

10491 10492 10493 10494 10495 10496 10497 10498 10499 10500 10501 10502 Reinstatement 10441 |

John Kear Melanie Berry John Li John Smith Kamal Berberi Adam Wellington Shaun Walker Alan Millard Alan Good Jonathon Meadows Gary Byrne Garth Allison

Dan Haines |

CCE CCE Exception Circuits Graphic plc Exception Circuits Graphic plc Merlin pcb Stevenage Circuits Graphic plc Stevenage Circuits Merlin pcb Merlin pcb

Viking Test |

Member Member Member Member Member Member Member Member Member Member Member Member

Associate |

|

| Go back to Contents | ||||

|

Section 15

|

Corporate Members of The Institute of Circuit Technology | |

| Adeon Technologies BV |

Weidehek 26,A1 4824 AS Breda,The Netherlands |

www.adeon.nl |

| Atotech UK Ltd. | William Street, West Bromwich. B70 0BE | www.atotech.com |

| CCE Europe | Wharton Ind. Est., Nat Lane, Winsford, CW7 3BS | www.ccee.co.uk |

| ECS Circuits Ltd. | Unit B7, Centrepoint Business Park, Oak Road, Dublin 12, Ireland | www.ecscircuits.com |

| Electra Polymers Ltd. | Roughway Mill, Dunks Green, Tonbridge, TN11 9SG | www.electrapolymers.com |

| The Eurotech Group | Salterton Industrial Estate, Salterton Road, Exmouth EX8 4RZ | www.eurotech-group.co.uk |

| Exception PCB Solutions | Ashchurch Business Centre, Alexandra Way, Tewkesbury, Gloucestershire. GL20 8NB | www.exceptionpcb.com/ |

| Merlin PCB Group | Hawarden Industrial Park, Manor Ln, Deeside, Flintshire, North Wales, CH5 3QZ | www.merlinpcbgroup.com |

| Faraday Printed Circuits Ltd | 15-19 Faraday Close, Pattinson North Ind. Est., Washington. NE38 8QJ | www.faraday-circuits.co.uk |

| Graphic plc | Down End, Lords Meadow Ind. Est.,Crediton EX17 1HN | www.graphic.plc.uk |

| GSPK (TCL Group) | Knaresborough Technology Park, Manse Lane, Knaresborough HG5 8LF | www.gspkcircuits.ltd.uk |

| Amphenol Invotec Ltd | Hedging Lane, Dosthill, Tamworth B77 5HH | amphenol-invotec.com |

| HMGCC | Park Rd, Milton Keynes MK19 7BH | www.hmgcc.gov.uk |

| Holders Technology UK | Tweedbank Industrial Estate, Tweedbank, Galashiels TD1 3RS | ww2.holderstechnology.com |

| Minnitron Ltd | 20 Leigh Road, Haine Industrial Park, Ramsgate, Kent CT12 5EU | www.minnitron.co.uk |

| PMD (UK) Ltd. | Broad Lane,Broad Lane,Coventry CV5 7AY | www.pmdgroup.co.uk |

| Rainbow Technology Systems | 40 Kelvin Avenue, Hillington Park, Glasgow G52 4LT | www.rainbow-technology.com |

| Stevenage Circuits Ltd | Caxton Way, Stevenage. SG1 2DF | www.stevenagecircuits.co.uk |

| Sun Chemical | Norton Hill, Midsomer Norton, Bath | www.sunchemical.com |

| Teledyne Labtech | Broadaxe Business Park, Presteigne LD8 2UH | www.teledynelabtech.com |

| Ventec Europe | 1 Trojan Business Centre, Tachbrook Park Estate, Leamington Spa CV34 6RH | www.ventec-europe.com |

| Zot Engineering Ltd | Inveresk Industrial Park Musselburgh, B19EH21 7UQ | www.zot.co.uk |

| Go back to Contents |

| Section 16 |

ICT Council Members |

| Council Members 2020: |

Emma Hudson (Chair), Andy Cobley (Past Chairman), Steve Payne (Deputy Chairman), Chris Wall (Treasurer), William Wilkie (Technical Director, Membership & Events), Richard Wood-Roe (Web Site), Lynn Houghton (Hon Editor), Matthew Beadell, Martin Goosey, Maurice Hubert, Lawson Lightfoot, Peter Starkey, Francesca Stern and Bob Willis, |

| Section 17 |

Editors Notes The ICT Journal |

|

Lynn Houghton Journal Editor |

Instructions/hints for Contributors 1. As it is a digital format the length is not an issue. Short is better than none at all! 2. Article can be a paper or a text version of a seminar or company presentation. Please include data tables, graphs, or powerpoint slides.We can shrink them down to about quarter of a page. Obviously not just bullet points to speak from. 3. Photo's are welcome. 4. We would not need source cross references 5. Title of presentation - Of course! Date, Job title of Author and Company represented. 6. An introductory summary of about 150 words would give the reader a flavour of what it's all about. 7. Style - we don't want out and out advertising but we do recognise that the speaker has a specialism in the product or process that will include some trade promotion. Sometimes it will be a unique process or equipment so trade specific must be allowed. 8. Date and any info relating to where or if this article may have been published before. 9. We can accept virtually any format. Word, Powerpoint, publisher, PDF or Open Office equivalents. 10. Also, to make it easy, the author can provide a word file to go along with his original powerpoint presentation and I/we can merge it together and select the required images. 11. A photo of author or collaborators.

I really do look forward to receiving articles for publication. Lynn Houghton |

Source: London Metal Exchange (www.lme.com)

Source: London Metal Exchange (www.lme.com)

Source: Ventec International Group

Source: Ventec International Group

Professor Martin Goosey

Professor Martin Goosey Section through a Nissan Leaf showing the Lithium-ion battery pack

Section through a Nissan Leaf showing the Lithium-ion battery pack An Aceleron Offgen all-in-one energy storage solution suitable for residential or commercial use (courtesy Aceleron Ltd)

An Aceleron Offgen all-in-one energy storage solution suitable for residential or commercial use (courtesy Aceleron Ltd) Example of part of a lithium-ion EV battery back and control ancillaries (© HSSMI)

Example of part of a lithium-ion EV battery back and control ancillaries (© HSSMI)